If you are being audited, amending may also send the wrong signal, further jeopardizing your position. If so, you are probably safe in not filing an amendment. Ask yourself whether the return you filed was accurate to your best knowledge when you filed it. In fact, you can be prosecuted for failure to file (a misdemeanor) or for filing falsely (a felony). Should you? It depends. You must file a tax return with the IRS each year if your income is over the requisite level. So gather those old receipts and claim the expenses before the ten-year deadline.Can you amend your taxes if you forgot something or made a mistake? Sure. CRA allows taxpayers to adjust returns going back 10 years.

#Amending turbotax return 2020 registration

If you’ve just realized you could have been claiming your child’s daycare expenses or soccer registration fees for the past few years, it’s not too late.

Along with the completed form, you’ll also need to include any supporting documents (receipts, slips, etc.). If you prefer to submit your adjustment request by paper, fill out a Form T1ADJ – T1 Adjustment Request and mail to your local tax centre.

#Amending turbotax return 2020 how to

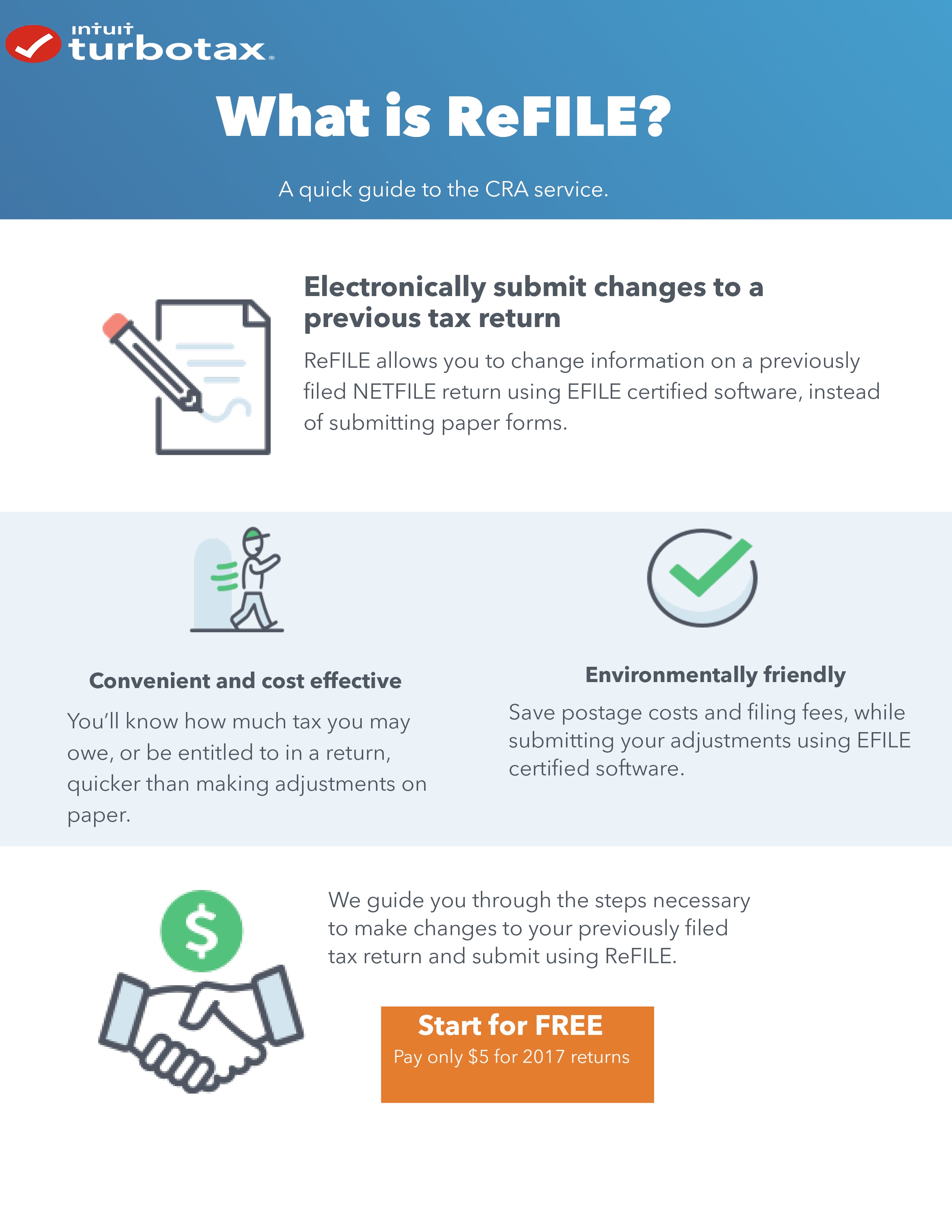

Check out CRA’s How to change your return webpage for details. You are allowed to make multiple adjustments all on one request. If you have more than one adjustment to make, try to have all of your information ready at once and do it all in one shot. If your adjustment request is not approved, you’ll receive a letter of explanation from CRA.Īs soon as you submit an adjustment request online, you can’t submit another until the first one has been finalized. Once your adjustment request has been processed, you’ll receive a Notice of Reassessment which outlines approved changes. Online adjustments process in about two weeks. You’ll choose the tax year you want to adjust and enter line numbers and figures to correct or add information. After signing into your account, click the “Change return” option from the left side. If you’re a CRA My Account holder, changes to your return can be submitted online via the portal. Adjustments filed by mail can take up to ten weeks to process. The average processing time for CRA My Account adjustments is about two weeks. Online submissions are usually much quicker. For example, if you’ve forgotten to include unused tuition to your return, CRA has those figures and may add the amounts to your return directly.ĬRA has two ways for you to file an adjustment request – online or by mail. Secondly, CRA may adjust your original return for you. First, an early adjustment request may lead to unnecessary delays in processing time for both the original return and the adjustment. This is important for a couple of reasons. You must wait until you have received your Notice of Assessment before submitting any adjustment requests. But you can correct the original by way of an adjustment. Once you’ve filed your return (mistakes and all), you can’t file a new one. The Canada Revenue Agency will only accept one return per tax year. Here’s how to change your tax return after you’ve filed. If you’ve already filed your return, correcting mistakes may be easier than you think. Whether it’s a T slip that arrived late or a forgotten RRSP contribution receipt, sometimes your tax return ends up missing a few details.

0 kommentar(er)

0 kommentar(er)